Irs 2024 Schedule 3 Form – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . The Internal Revenue Service (IRS) has released the tax refund schedule for the year Another change for the 2024 tax season is the elimination of the Form 1040EZ. Taxpayers who previously .

Irs 2024 Schedule 3 Form

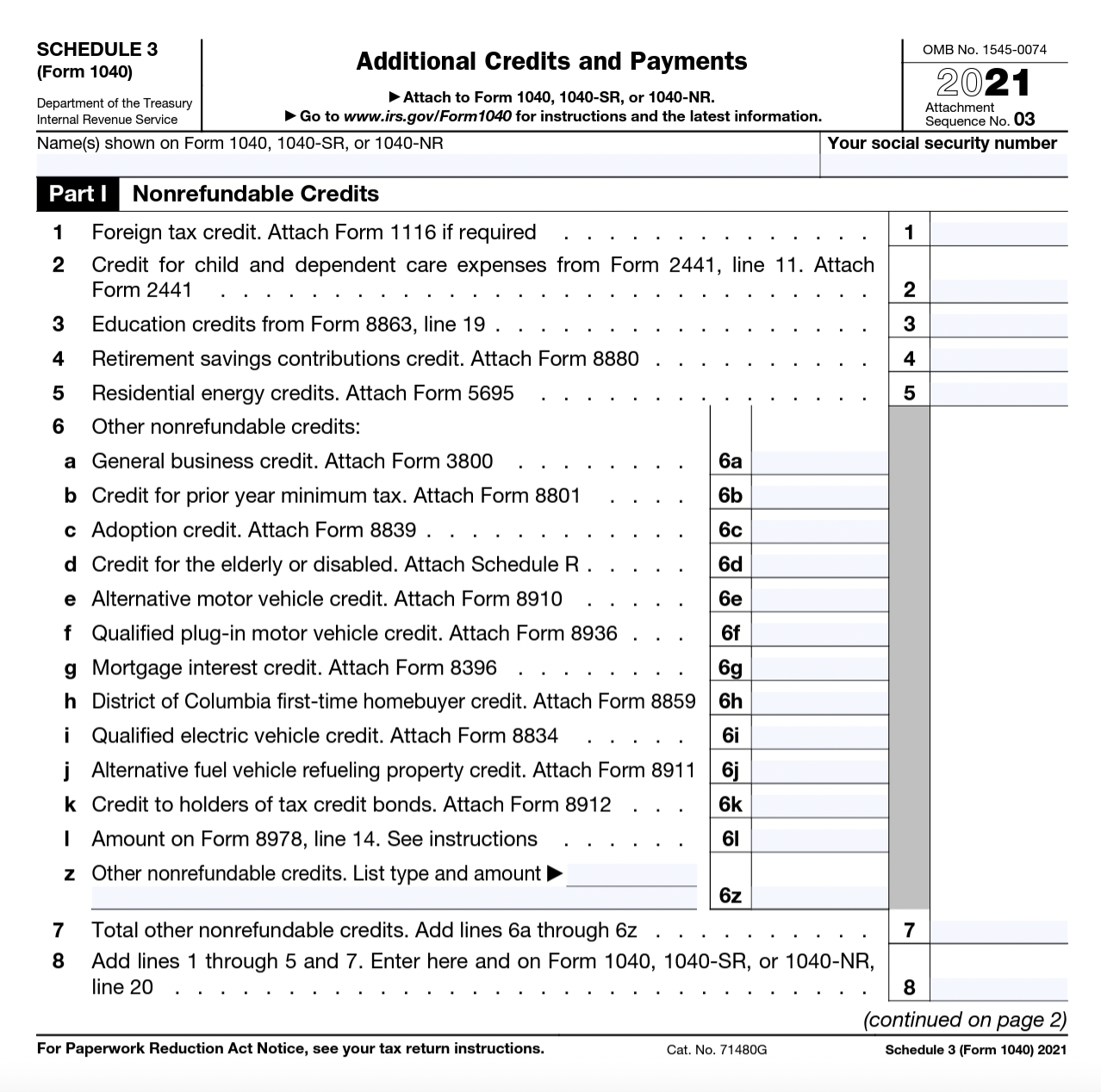

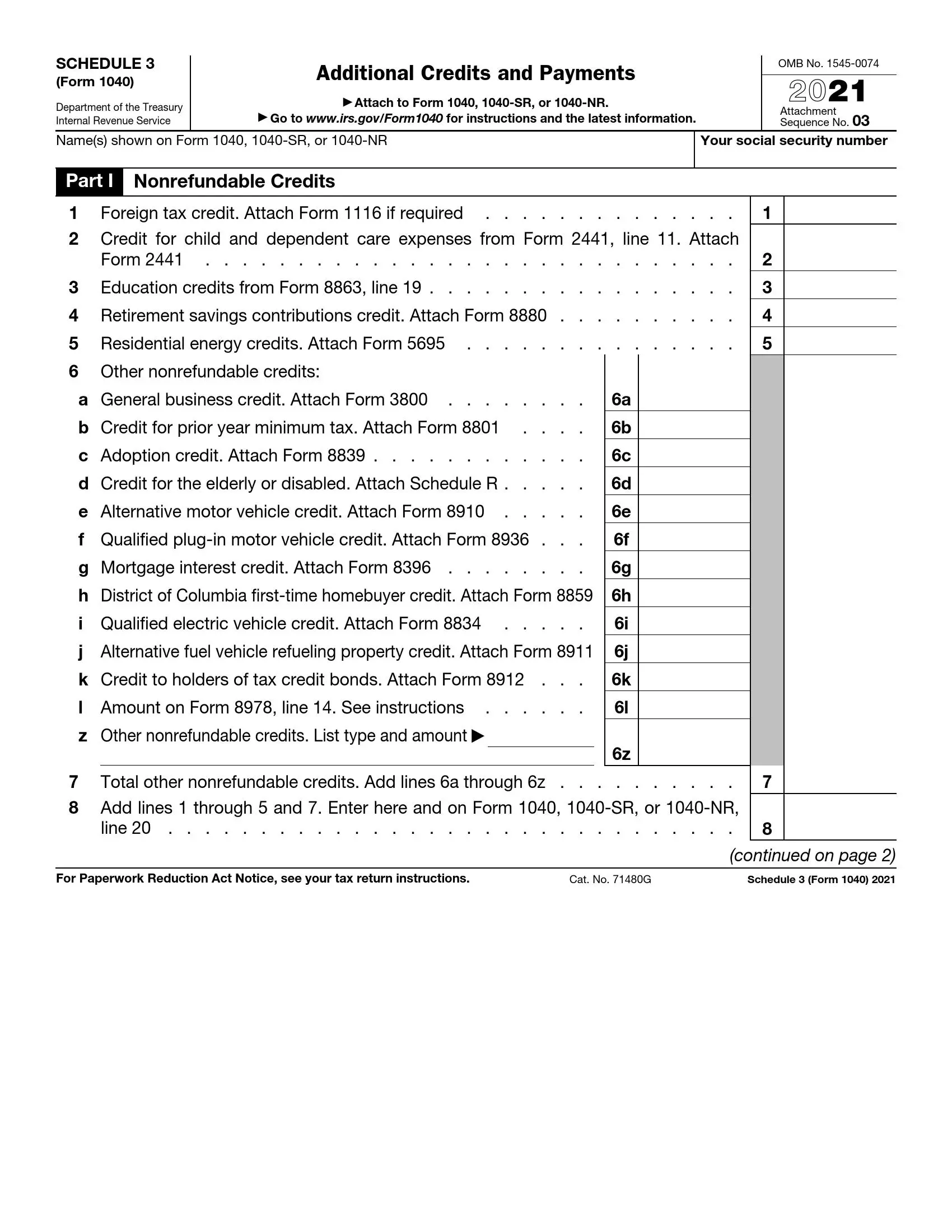

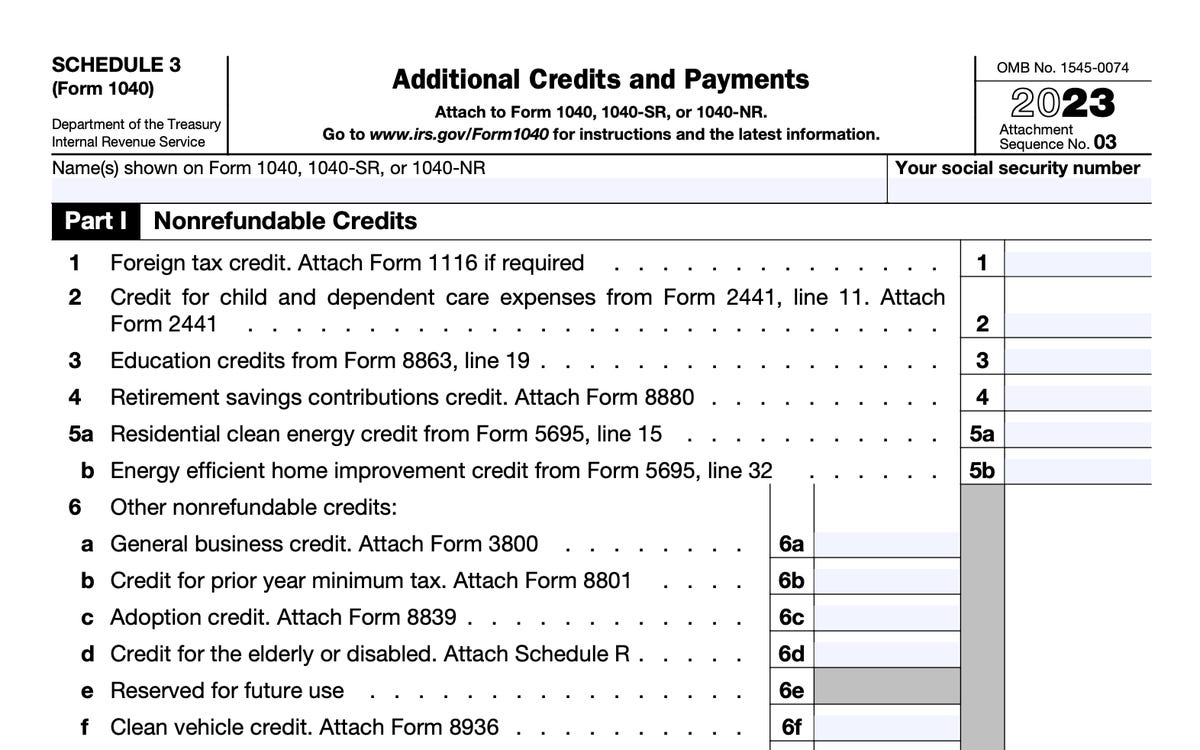

Source : www.irs.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.comInstructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024)

Source : www.irs.govIRS 1040 Schedule 3 2020 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comMost commonly requested tax forms | Tuition | ASU

Source : tuition.asu.eduIRS Schedule 3 Form 1040 or 1040 SR ≡ Fill Out Printable PDF Forms

Source : formspal.com2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comIRS Releases Schedule 3 Tax Form and Instructions for 2023 and

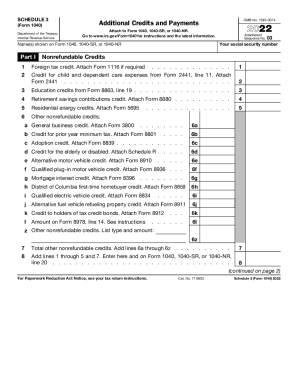

Source : www.kxan.comIRS 1040 Schedule 3 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comTax Credits Could Bring You a Big Tax Refund, Even if You Don’t

Source : www.cnet.comIrs 2024 Schedule 3 Form 2023 Schedule 3 (Form 1040): The Tax Relief for American Families and Workers Act of 2024 is currently making its way to the Senate would raise the refundable portion cap of child tax credit from $1,800 to $1,900 to $2,000 each . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

]]>