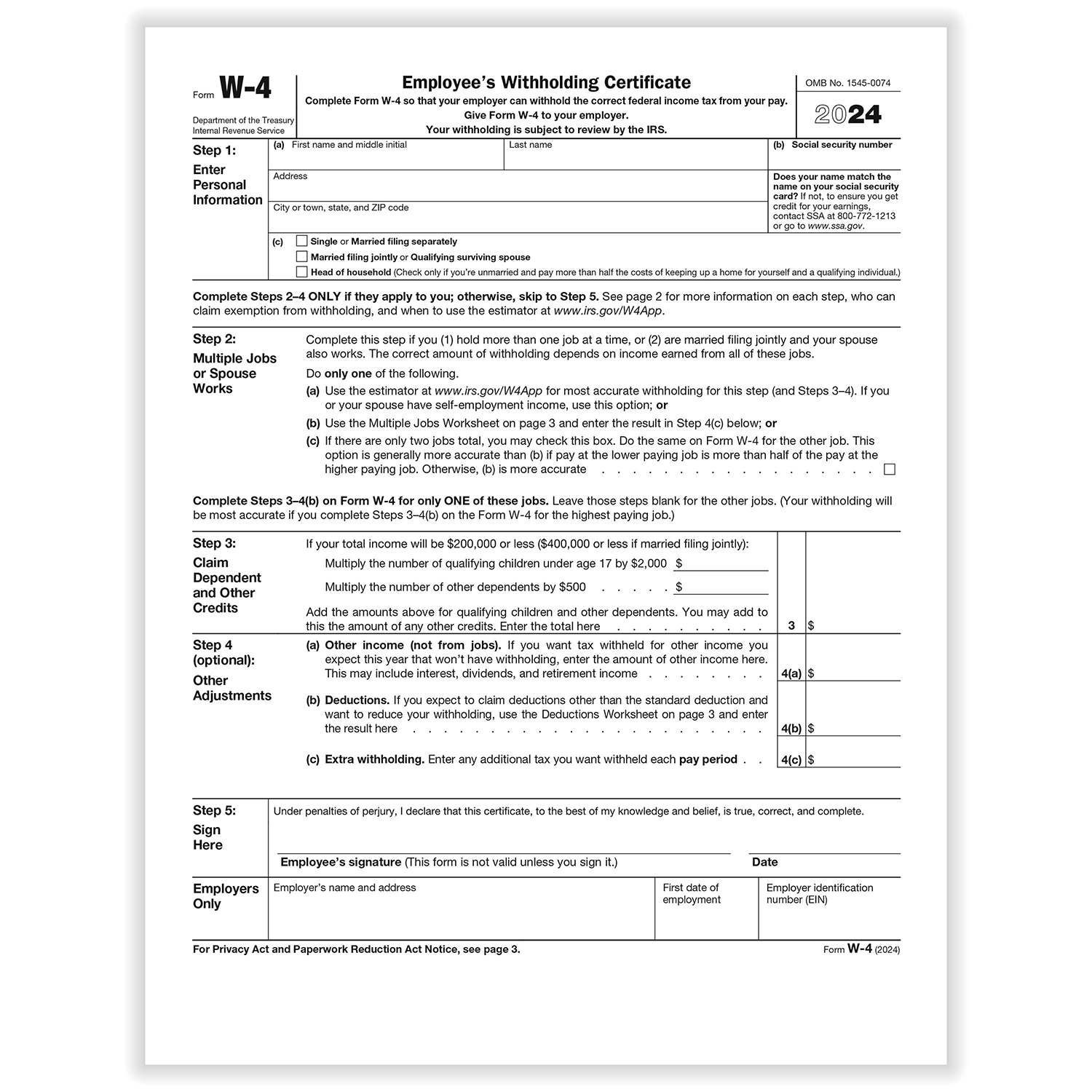

Form 2024 Irs 2024 – With a potential child tax credit expansion, you might be wondering if you should hold off on filing your taxes. We’ll help you figure out what to do. . Feb. 15, 2024 If you are tax-exempt, this would be your deadline to file a Form W-4 with your employer if you intend to reclaim the exemption for 2024. April 15, 2024: Tax Day -For regular filing of .

Form 2024 Irs 2024

Source : www.wolterskluwer.comEverything to know before filing taxes in 2024, according to the

Source : www.masslive.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

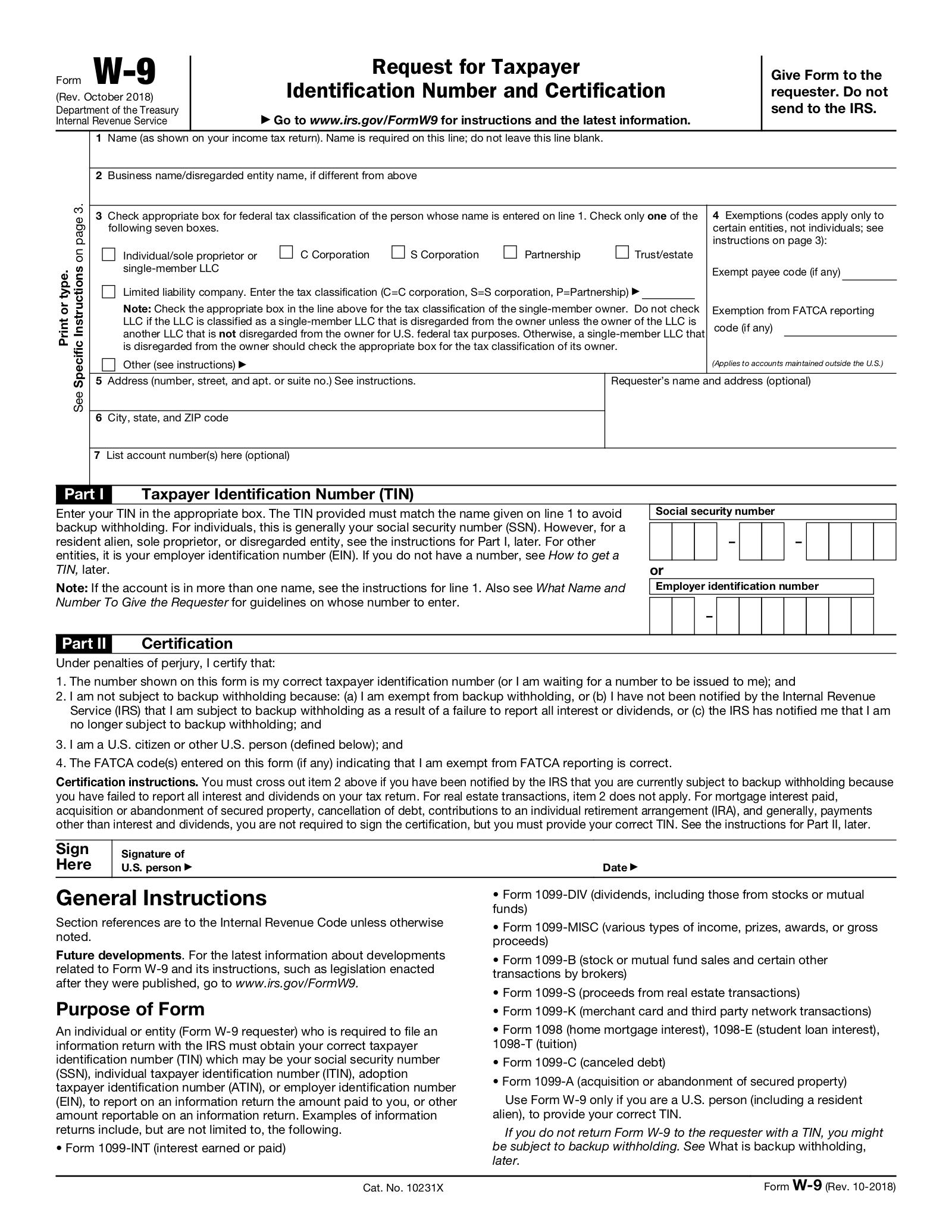

Source : money.comFree IRS Form W9 (2024) PDF – eForms

Source : eforms.com2024 Form W 4P

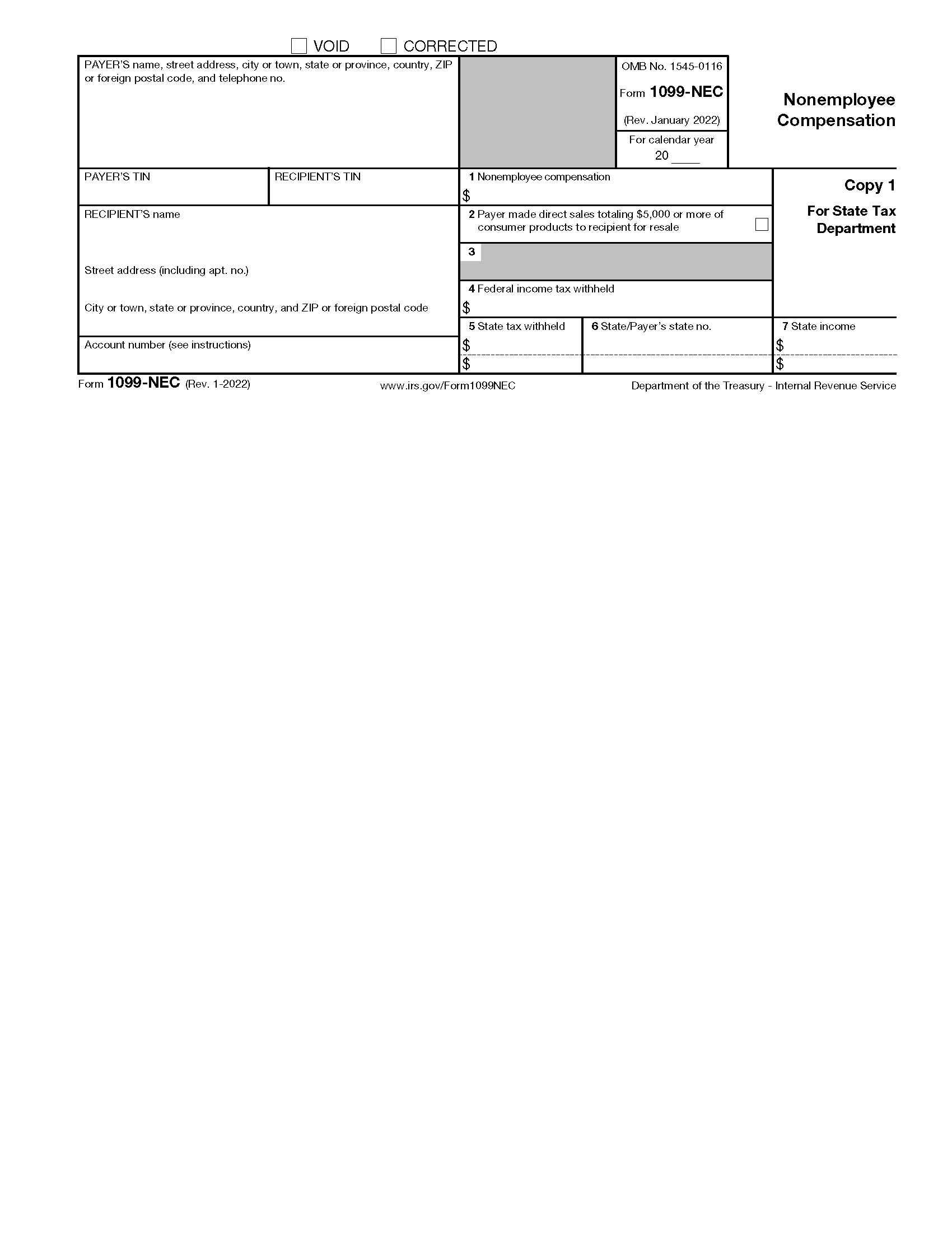

Source : www.irs.govFree IRS 1099 NEC Form (2021 2024) PDF – eForms

Source : eforms.comEmployee’s Withholding Certificate

Source : www.irs.gov2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.comIRS Releases 2024 Publication 15 T and Forms W 4, W 4P, and W 4R

Source : www.payroll.orgTax Brackets 2024: What are the new brackets that you must paid to

Source : www.marca.comForm 2024 Irs 2024 IRS Releases 2024 Form W 4R | Wolters Kluwer: According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. . The Tax Relief for American Families and Workers Act of 2024 is currently making its way to the Senate would raise the refundable portion cap of child tax credit from $1,800 to $1,900 to $2,000 each .

]]>